|

|

Return to A Better Holyoke for All PAC website  View the ballot question results Official statement: "This was an overwhelming victory for the people of Holyoke. This victory sends a powerful message to Boston that they run our schools and they need to provide the money Holyoke's children deserve! We look forward to a new more inclusive process that protects Holyoke's renters, homeowners and businesses. A process that improves our schools and also addresses all of the needs of our city on a budget our city can actually afford. We congratulate the people of Holyoke on their victory! Thank you." Yard signs will be picked up over the next few days If your yard sign has not been picked up by the end of Saturday, Nov. 9, CLICK HERE Thanks to all who helped get the message out! Holyoke votes down the Prop. 2 1/2 Debt Exclusion Tax Override:There's a Better Way For Holyoke! |

|

||||

en espa�ol |

|

click here |

||

Holyoke Public Schools Proposal to Build 2 New Schools Is a Very Bad Idea and a Costly Mistake that mortgages our Children�s future and wastes $80+ Million dollars!

City Hall has placed a binding tax override on the ballot to fund an alleged $132 Million Bond to build 2 new middle schools � the largest tax increase in city history! - Our Mailer Front [PDF] - Our Mailer Back [PDF]

- Our Mailer Front [PDF] - Our Mailer Back [PDF]

The following reasons explain why this is a really, really bad idea for our city�s future and why you should vote NO on November 5th.

Unaffordable and Unsustainable

Holyoke is currently mired in debt and unfunded future liabilities.

The city has its current debt obligations of approximately $50 million. This one vote will more than double the current indebtedness of the city. The city share after state aid of the $132 million will be $55 million. After accounting for required interest payments, these 2 debt streams will cost almost $200 million over the next 30 years.

Still unfunded and known is numerous CSO sewer work estimated at $20-30 million, $60 million in unfunded pension obligation, $300 million in GASB 45 unfunded health insurance liability. Also unfunded and known at this time is tens of millions in needed infrastructure improvements to parks, roads, buildings, equipment and vehicles.

Unfunded and unknown will be the tens of millions in capital needs the city will have over the life of the proposed 30 year bond. There will be no financial liquidity to pay for these without further debt and even higher taxes.

Meanwhile, the city has no free cash reserves. The city has a multi-million dollar growing structural budget deficit which means you are bringing in much less than is needed to cover the budget on an annual basis. The hole is continuing to get deeper and deeper. The Stabilization fund is much lower than it needs to be and already the city is using interest from it to cover basic expenses. No principal payments are being made into the Stabilization Fund. The city is literally one state aid cut away from total financial collapse of the fund. Any combination of property value reductions, state aid cuts over one year and the city is looking at total fiscal insolvency. Moreover, at the current rate of budget growth and debt obligation growth, the city will not have the resources it needs to stay solvent long term.

Uncertain future revenue

The city has already lost its #2 taxpayer in the Mt Tom Power Plant - a loss of over $1.5 million per year due to regulatory pressures. Now with this proposal your #1 taxpayer, the Holyoke Mall, is saying that it would be an �Extreme Hardship� on them to survive. The Holyoke Mall pays 15% of our entire tax levy, a sum of $8.1 Million. This proposal would add $608,000 to their annual tax bill. Retail Malls are already under enormous financial pressure and transformation, they do not need more back breaking tax increases to put them under any faster. Moreover, based on the trend line of the retail sector, how can anyone on the City Council guarantee they will be here to make the required payments? If they do not make it, all of the other residents and businesses in the city will be required to pay their $8.7 million share. That would crush the other 85% of taxpayers left into financial ruin. It would be so destabilizing to the city that the city would have to declare bankruptcy and/or be placed into receivership. That would have a disastrous impact on the remaining property values of the city.

These 2 reasons alone make it an absurd proposition to support putting a bond for this much debt on the ballot because if it were to pass the city could not manage the consequences. It is a reckless and completely irresponsible proposition to advance.

The new Tax Burden will be Unsustainable

With a $2.72 Commercial Industrial Rate increase, Holyoke will now by far have the highest commercial tax rates in Massachusetts at $42.59 per thousand of value. It is inconceivable to see how any business will want to start in Holyoke. Likewise, it reduces the marketability of any business that is already here.

$1.27 Residential Tax Increase will place Holyoke at the Top 5% of all Residential Rates in Massachusetts. It also will make Holyoke among the very worst tax bill burden paid to income ratio in the state. This means that Holyoke residents will be paying much more of their income in real dollars to property tax than nearly every other resident of the state.

These two factors are a recipe for financial disaster.

What more do you need to hear to vote NO?

There are alternatives:

This is not time sensitive as supporters have said. The schools could wait to put together a responsible plan to the state that the city could actually afford and submit it to the state next funding cycle. It has waited this many years, what is one more?

It is imperative that we get the 80% State Reimbursement � The city cannot afford to give up its 80% reimbursement allowance for a 57% funding allowance due to cost overruns in this proposed project. The city needs to fight for this $30 Million dollar difference.

Renovate the schools, build 1 new school or take back Lynch Middle School are also viable options.

| Lynch School | Anniversary Field | 1952 Construction |

|  |  |

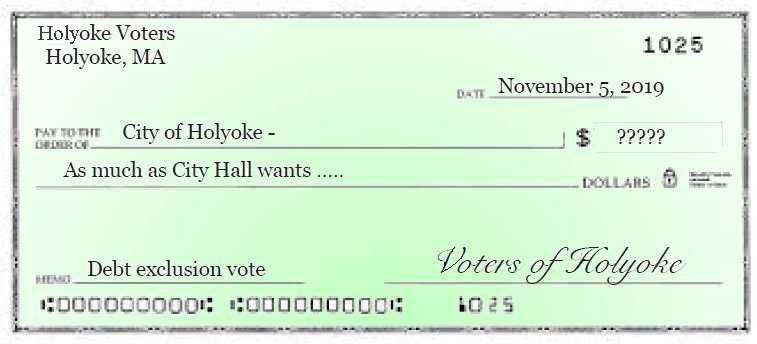

Don�t sign a Blank Check to City Hall!

Firstly, the question itself is misleading and does not tell the taxpayers how much it is going to cost or for how long they are going to have to pay! That is absurd and they just expect voters to give them whatever they want!

In public statements the Proponents say it is going to cost the voters $132 Million for 30 years. However, the Truth of the Matter is The City Council is not planning on voting on the actual Bond to fund the school project until AFTER they wait to see if the voters approve the Blank Check proposal.

If the voters approve the Debt Exclusion prior to the bond vote of the City Council, the City could change the amount of the request to whatever they want and for as long as they want. If approved, the city will be given the authority to increase the amount of debt exclusion automatically if there are cost overruns or other �unknown additional� costs! The voters just have to pay whatever they say with no additional votes required. You are locked in for as long as they say for whatever amount they say.

The city is literally asking the residents to approve a Blank Check. Why would any voter want to give City Hall, with its past track record of financially irresponsible decisions, the authority to spend whatever they want? How can they even expect us to give them that type of authority?

| Summary | Click here to Request a Yard Sign ---- |

| In the end, the proposal to approve the proposed $132 million tax override vote is an irresponsible and reckless request. If approved by the voters, it will saddle the city with a debt the likes of which we have never faced. The emotional pleas of �Do it for the kids� will one day turn to how could we have been so short sighted? The reality of a bankrupt city will have a stinging effect that will last much longer than the short term euphoria of a glamorous ribbon cutting. Our kids will become adults one day, and our kids deserve us acting like adults right now and that means dealing with reality not emotion. Dealing with things as they are and not recklessly hoping for the best. |  |

| As good stewards we acknowledge we are only here for a point in time, and we owe it to the future generations to leave the city in a stronger position than how we received it. Spending money we do not have, and taking on debt we cannot afford to pay is no way to run our city. Please vote NO on November 5, 2019. | |

Back to Top